Indian Economy

India is a developing country and our economy is a mixed economy where the public sector co-exists with the private sector. For an overview of Indian Economy, we should first go through the strengths of Indian economy.

India is likely to be the third largest economy with a GDP size of $15 trillion by 2030.The economy of India is currently the world’s fourth largest in terms of real GDP (purchasing power parity) after the USA, China and Japan and the second fastest growing major economy in the world after China.

Indian economy growth rate is estimated to be around seven to eight percent by year 2015-16.

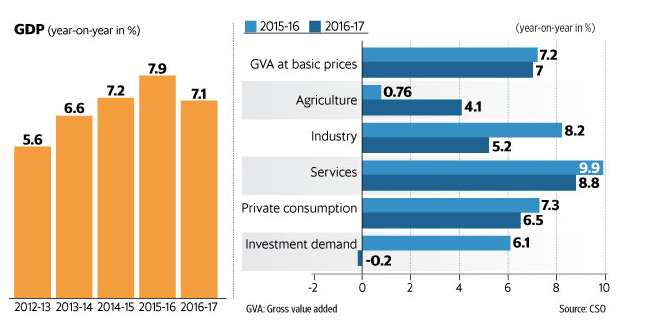

The Economic Survey 2016-17, was tabled in the Parliament on January 31, 2017, by Mr Arun Jaitley, Union Minister for Finance, Government of India. The Survey forecasts a growth rate of 6.75 to 7.5 per cent for FY18, as compared to the expected growth rate of 6.5 per cent in FY17. Over the medium run, the implementation of the Goods and Services Tax (GST), follow-up to demonetisation, and enacting other structural reforms should take the economy towards its potential real GDP growth of 8 per cent to 10 per cent.

Introduction to Indian Economy:-

- Low per capita income.

- Inequalities in income distribution.

- Predominance of agriculture. (More than 2/3rd of India’s working population is engaged in agriculture. But in USA only 2% of the working population is engaged in agriculture.)

- Rapidly growing population with 1.2% annual change.

- Chronic unemployment (A person is considered employed if he / she works for 273 days of a year for eight hours every day.)Unemployment in India is mainly structural in nature.

- Low rate of capital formation due to less saving rate.

- Dualistic Nature of Economy (features of a modern economy, as well as traditional).Mixed Economy

- Follows Labour Intensive Techniques and activities.

Agriculture in Indian Economy:-

While Indian economy introduction is started, the major focus is always on the agriculture sector. This is because Indian economy is based on agriculture.52% of the total population of India depends on agriculture.

According to the 2011-2012 survey of Indian agriculture contributes 14.1% of the Gross Domestic Product (GDP). It was 55.4% in 1950-1951.

India is the second largest sugar producer in the world (after Brazil).

In tea production, India ranks first. (27% of total production in the world).

Wheat production: Uttar Pradesh is the largest producer. Punjab and Haryana is then the second and the third largest producer of wheat.

Rice production:The principal food grain in India is rice. West Bengal is the largest producer. Uttar Pradesh is the second largest producer of Punjab and is the third largest producer of rice.

National Income:-

The national income is the sum total of the value of all the final goods produced and services of the residents of the country in an accounting year.

MIND IT !

CSO: Central Statistical Organization is under the Department of Statistics. Govt. of India is responsible for estimating the national income.CSO was founded by Prof. Mahalanobis. CSO is assisted by the National Sample Survey Organization (NSSO) in estimating National Income.

Gross Domestic Product (GDP) is the money value of final goods and services produced in the domestic territory of a country during the accounting year.

In India Gross Domestic Product (GDP) is larger than national income because net factor income from abroad is negative, i.e. foreign payment is larger than the foreign receipt.

India GDP Growth Rate

The Gross Domestic Product (GDP) in India expanded 1.50 percent in the first quarter of 2017 over the previous quarter. GDP Growth Rate in India averaged 1.67 percent from 1996 until 2017, reaching an all time high of 6.20 percent in the second quarter of 2009 and a record low of -2.30 percent in the first quarter of 2009.

Net National Product (NNP) at market prices = Gross National Product at Market Prices – Depreciation

Sectors of Indian Economy:-

1. Primary Sector: When the economic activity depends mainly on exploitation of natural resources then that activity comes under the primary sector. Agriculture and agriculture related activities are the primary sectors of economy.

2. Secondary Sector: When the main activity involves manufacturing then it is the secondary sector. All industrial production where physical goods are produced come under the secondary sector.

3. Tertiary Sector: When the activity involves providing intangible goods like services then this is part of the tertiary sector. Financial services, management consultancy, telephony and IT are examples of service sector.

Other Classifications of Economy:-

In Indian economy introduction, the sectors of economy based on other basis is also required to get a clear picture of the strengths of Indian Economy.

1. Organized Sector: The sector which carries out all activity through a system and follows the law of the land is called organized sector. Moreover, labour rights are given due respect and wages are as per the norms of the country and those of the industry. Labour working organized sector get the benefit of social security net as framed by the Government. Certain benefits like provident fund, leave entitlement, medical benefits and insurance are provided to workers in the organized sector. These security provisions are necessary to provide source of sustenance in case of disability or death of the main breadwinner of the family without which the dependents will face a bleak future.

2. Unorganized Sector: The sectors which evade most of the laws and don’t follow the system come under unorganized sector. Small shopkeepers, some small scale manufacturing units keep all their attention on profit making and ignore their workers basic rights. Workers don’t get adequate salary and other benefits like leave, health benefits and insurance are beyond the imagination of people working in unorganized sectors.

3. Public Sector: Companies which are run and financed by the Government comprises the public sector. After independence India was a very poor country. India needed huge amount of money to set up manufacturing plants for basic items like iron and steel, aluminium, fertilizers and cements. Additional infrastructure like roads, railways, ports and airports also require huge investment. In those days Indian entrepreneur was not cash rich so government had to start creating big public sector enterprises like SAIL (Steel Authority of India Limited), ONGC(Oil & Natural Gas Commission).

4. Private Sector: Companies which are run and financed by private people comprise the private sector.Companies like Hero Honda, Tata are from private sectors.

GST & Demonetisation:-

- The GST will create a common Indian market, improve tax compliance and governance, and boost investment and growth; it is also a bold new experiment in the governance of India’s cooperative federalism.

- The two largest denomination notes, Rs 500 and Rs 1000—together comprising 86 per cent of all the cash in circulation—were “demonetised” with immediate effect, ceasing to be legal tender except for a few specified purposes, on November 8, 2016.

- Demonetisation has had short-term costs in the form of slow growth but holds the potential for long-term benefits. Long-term benefits include reduced corruption, greater digitalisation of the economy, increased flows of financial savings, and greater formalisation of the economy, all of which could eventually lead to higher GDP growth, better tax compliance and greater tax revenues.

MIND IT !

Here are the most frequently asked Indian Economy questions in General knowledge section of exams. These questions will be useful for your practice for IBPS, SSC, UPSC exams, state PSC exams, entrance exams, bank exams, NEET exam (National Eligibility and Entrance Test) or any other competitive exams.

LearnFrenzy provides you lots of fully solved "Indian Economy" Questions and Answers with explanation.